By Daniel B. Klein, Ariel Cudkowicz, Christina Duszlak, and Jean M. Wilson

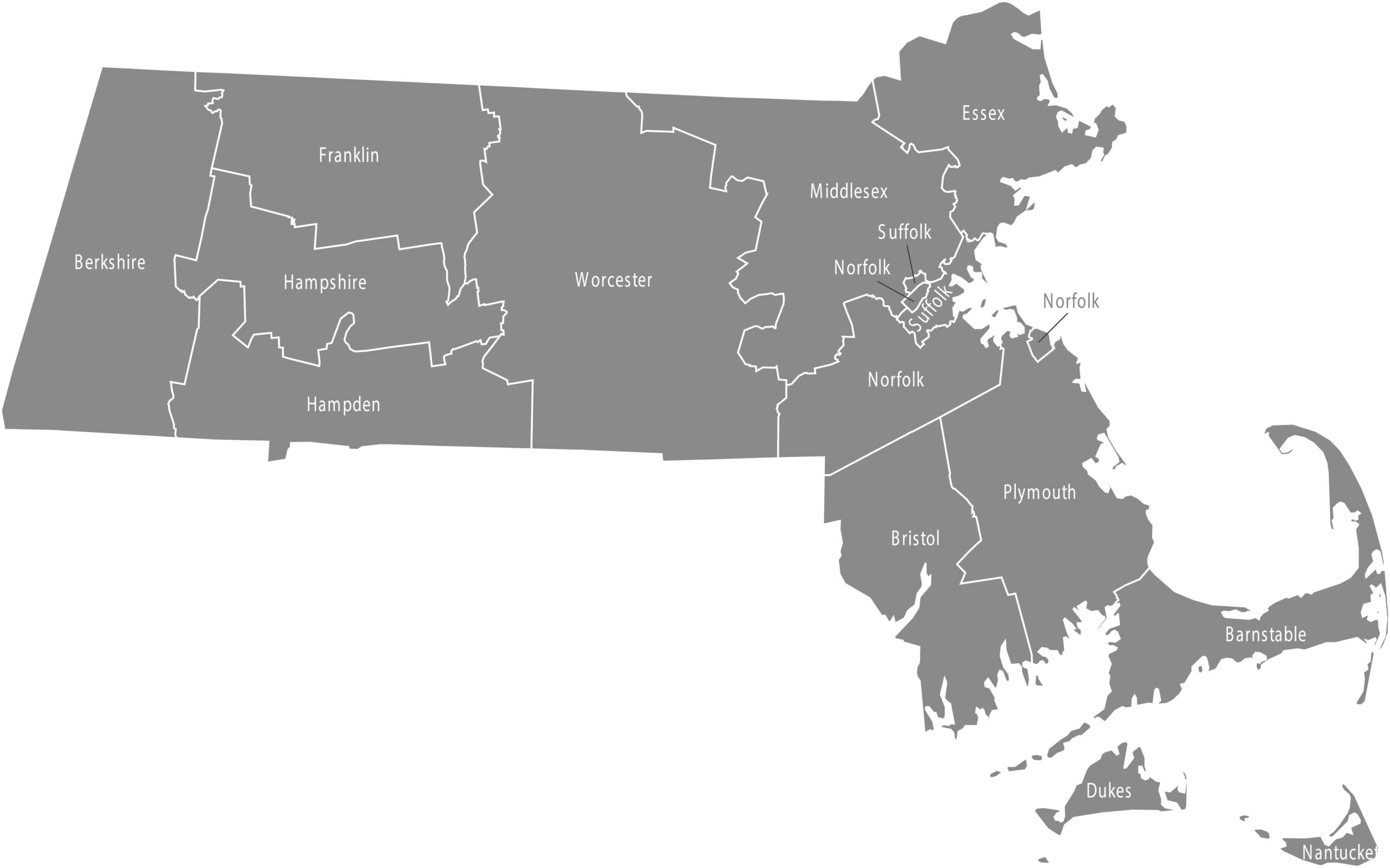

Seyfarth Synopsis: Effective November 1, 2023, the Massachusetts Paid Family and Medical Leave (PFML) law will allow employees to supplement (i.e. “top off”) benefits received from the Commonwealth of Massachusetts with any available accrued paid leave (e.g., sick time, vacation, PTO, personal time, etc.).

Continue Reading Important Change to Massachusetts PFML Law: Employees May Supplement (Top Off) PFML Benefits with Vacation, PTO, and Sick Time

Seyfarth Synopsis: In a recent ruling,

Seyfarth Synopsis: In a recent ruling,  Seyfarth Synopsis: The WHO and the CDC issued statements and FAQs on the monkeypox disease, declaring the disease a “Public Health Emergency of International Concern.”

Seyfarth Synopsis: The WHO and the CDC issued statements and FAQs on the monkeypox disease, declaring the disease a “Public Health Emergency of International Concern.”  Seyfarth Synopsis: Illinois recently amended its Child Bereavement Leave Act to expand the reasons for leave, including miscarriage and stillbirth, and adds additional covered family members. The law will now be called the “Family Bereavement Leave Act” and goes into effect on January 1, 2023.

Seyfarth Synopsis: Illinois recently amended its Child Bereavement Leave Act to expand the reasons for leave, including miscarriage and stillbirth, and adds additional covered family members. The law will now be called the “Family Bereavement Leave Act” and goes into effect on January 1, 2023.  Seyfarth Synopsis: The Eleventh Circuit Court of Appeals recently provided several reminders to employers regarding their obligations under the Family and Medical Leave Act (FMLA), in vacating summary judgment for the employer in

Seyfarth Synopsis: The Eleventh Circuit Court of Appeals recently provided several reminders to employers regarding their obligations under the Family and Medical Leave Act (FMLA), in vacating summary judgment for the employer in  Seyfarth Synopsis: The U.S. Court of Appeals for the Ninth Circuit recently became the seventh federal appellate court to hold that the standard for “willful” violations under the Family and Medical Leave Act is whether the employer knows or shows reckless disregard for whether its conduct violates the FMLA.

Seyfarth Synopsis: The U.S. Court of Appeals for the Ninth Circuit recently became the seventh federal appellate court to hold that the standard for “willful” violations under the Family and Medical Leave Act is whether the employer knows or shows reckless disregard for whether its conduct violates the FMLA.  Seyfarth Synopsis: On August 18, 2020, the U.S. Court of Appeals for the Seventh Circuit

Seyfarth Synopsis: On August 18, 2020, the U.S. Court of Appeals for the Seventh Circuit  Seyfarth Synopsis: Seven years ago today The Employment Law Lookout Blog launched its twice weekly publications. Now as we enter a new year — we wanted to celebrate this milestone by taking a look back at our seven most popular posts of “all time.” (As compiled by our marketing team and

Seyfarth Synopsis: Seven years ago today The Employment Law Lookout Blog launched its twice weekly publications. Now as we enter a new year — we wanted to celebrate this milestone by taking a look back at our seven most popular posts of “all time.” (As compiled by our marketing team and